K8凯发官方网的简介

company profile

- 关于K8凯发官方网

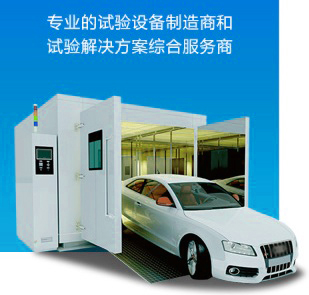

- 林频仪器是可靠性环境试验设备行业中的股份制高新技术企业,专业的恒温恒湿箱试验设备制造商和试验k8凯发官方网站的解决方案综合服务商,拥有标准化的试验设备生产基地和设备展示厅。凭借创新的产品、高效的供应链和强大的战略执行力,林频仪器锐意为广大用户打造优质、安全、环保的产品及专业高效的服务。

林频仪器产品系列包括:恒温恒湿箱、恒温试验箱、温湿度试验箱、循环试验箱、恒温恒湿试验箱、光照试验箱、老化试验箱、冲击试验箱、ip防护试验设备、恒温恒湿实验室、步入式试验室、盐雾腐蚀试验室、非标产品等全系列环境恒温恒湿箱试验设备。...